Federal Tax Credit for Heat Pump Water Heaters ended on December 31, 2025.

See below for details.

NOTICE: Include A. O. Smith's Qualified Manufacturer (QM) code A5X5 when filing a federal tax return form 5695.

Homeowners who purchased and installed heat pump water heaters by December 31, 2025 may be eligible to claim a federal tax credit. With potential savings of hundreds of dollars per year on energy bills, this limited-time incentive made upgrading more affordable than ever.

Don't forget you can also claim your federal tax credit for gas tankless water heaters worth up to $600.

What Is the Federal Tax Credit for Heat Pump Water Heaters?

A federal tax break is available for homeowners who installed a heat pump water heater by Dece,ber 31, 2025. If you are one of these homeowners, then you can claim 30% of your total standard project costs back on your federal taxes, up to a maximum of $2,000. The credit covers the equipment and standard installation by a pro.

The credit works for homeowners and renters who upgraded. Savings for heat pump water heaters have a $2,000 yearly limit, separate from the $1,200 limit for other upgrades like insulation, doors, and windows. This means you could claim up to $3,200 in a single year if you completed both projects by December 31, 2025.

NOTICE: Include A. O. Smith's Qualified Manufacturer (QM) code A5X5 when filing a federal tax return form 5695.

See how much the Arizona heat pump water heater promotions can save you—check local deals and find an installer who can help.

How Heat Pump Water Heaters Work

Heat pump water heaters operate using a four-step process:

1. Air Intake: A fan pulls ambient air through an evaporator

2. Heat Absorption: The Refrigerant in the evaporator absorbs heat from the air

3. Compression: The refrigerant passes through a compressor, raising temperature and pressure

4. Heat Transfer: Heated refrigerant flows through condenser coils around the tank, transferring heat to the water

This process uses existing heat in your home's air rather than generating heat through electric resistance, making it significantly more efficient.

Visit our water heater rebate center for more info on the federal tax credit worth up to $2,000 and additional savings opportunities in your area.

Cost Savings Breakdown

A. O. Smith's ProLine XE® Voltex® heat pump water heaters can save homeowners an average of $600 per year. A family using this model can go from spending $800 to $900 annually on water heating to just $200 to $300 per year. These units come with a 10-year limited warranty, but are likely to last 12 to 15 years, and maybe more, so the savings add up over time.

Who Qualifies for the Tax Credit

To qualify for the federal tax credit, your heat pump water heater needs to meet:

Equipment Standards:

- ENERGY STAR® certified heat pump water heaters only. ENERGY STAR® certification means the unit meets government standards for energy efficiency. Look for the blue ENERGY STAR® label when shopping.

- Must meet strict government efficiency standards.

- New equipment only (used units don't qualify).

Property Requirements:

- Your house has to already be built—no new construction.

- Has to be in the US.

- Homeowners and renters qualify.

- Vacation homes are fine, but if it's a rental, you have to live there.

Installation Guidelines:

- Get it professionally installed—it's worth it for the performance.

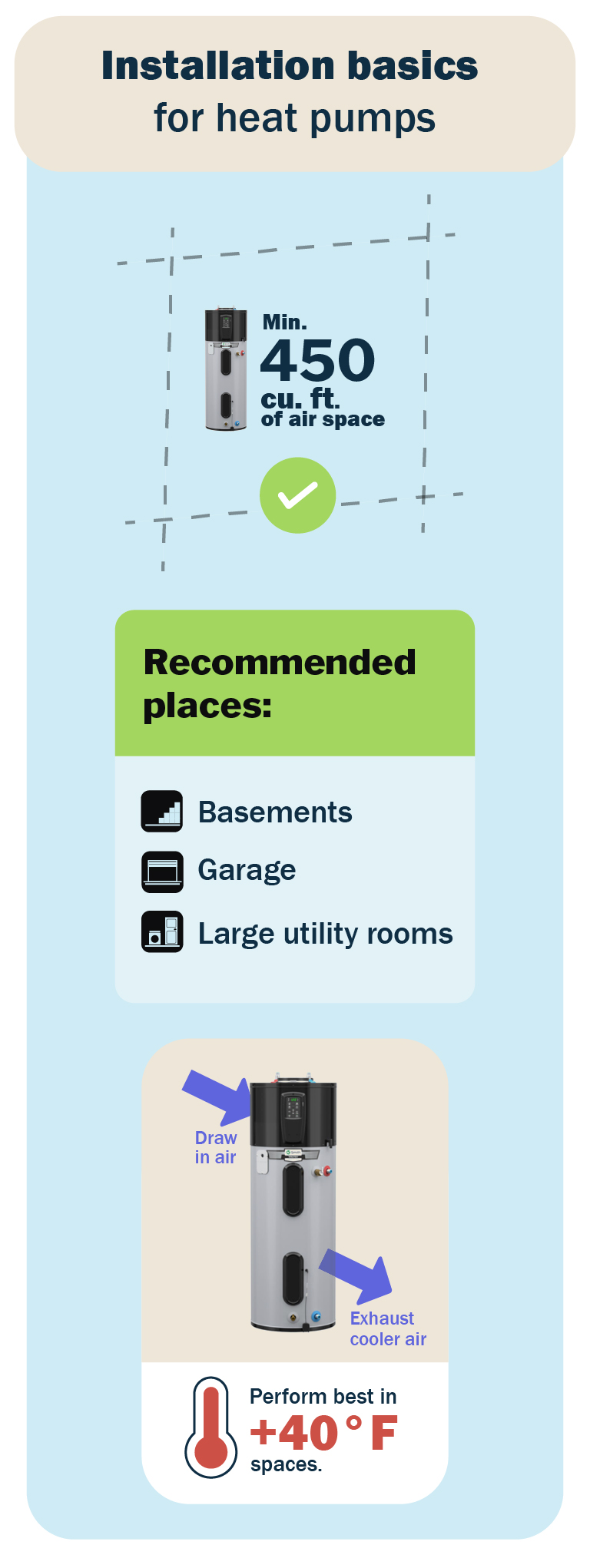

- Federal tax credits apply to installations with at least 450 cubic feet of air space, though manufacturers usually recommend 1,000+ cubic feet for best performance.

- Install it between 2023 and December 31, 2025.

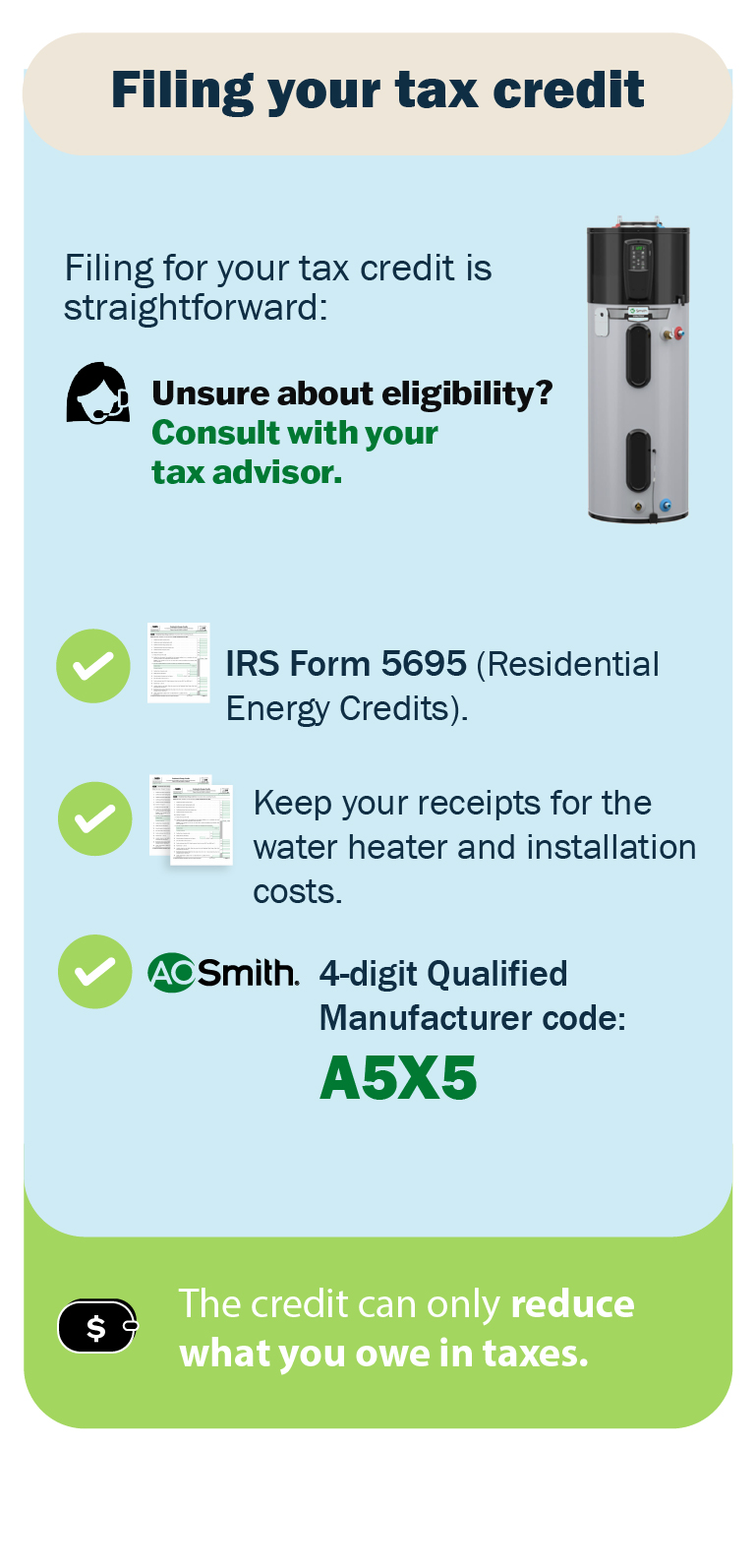

Filing Your Tax Credit

Filing for your tax credit is straightforward. If you're unsure about applicability, consult with your tax advisor.

You'll use IRS Form 5695 when you file your taxes. Keep your receipts for the water heater and installation costs, and you'll need the Qualified Manufacturer's (QM) code A5X5.

The credit can only reduce what you owe in taxes, meaning you can't get money back beyond that amount. If you're planning other home improvements, timing them together in the same year might help you save more.

Important: You may need to subtract any rebates or utility discounts from your total costs. A tax professional can help make sure you claim everything correctly.

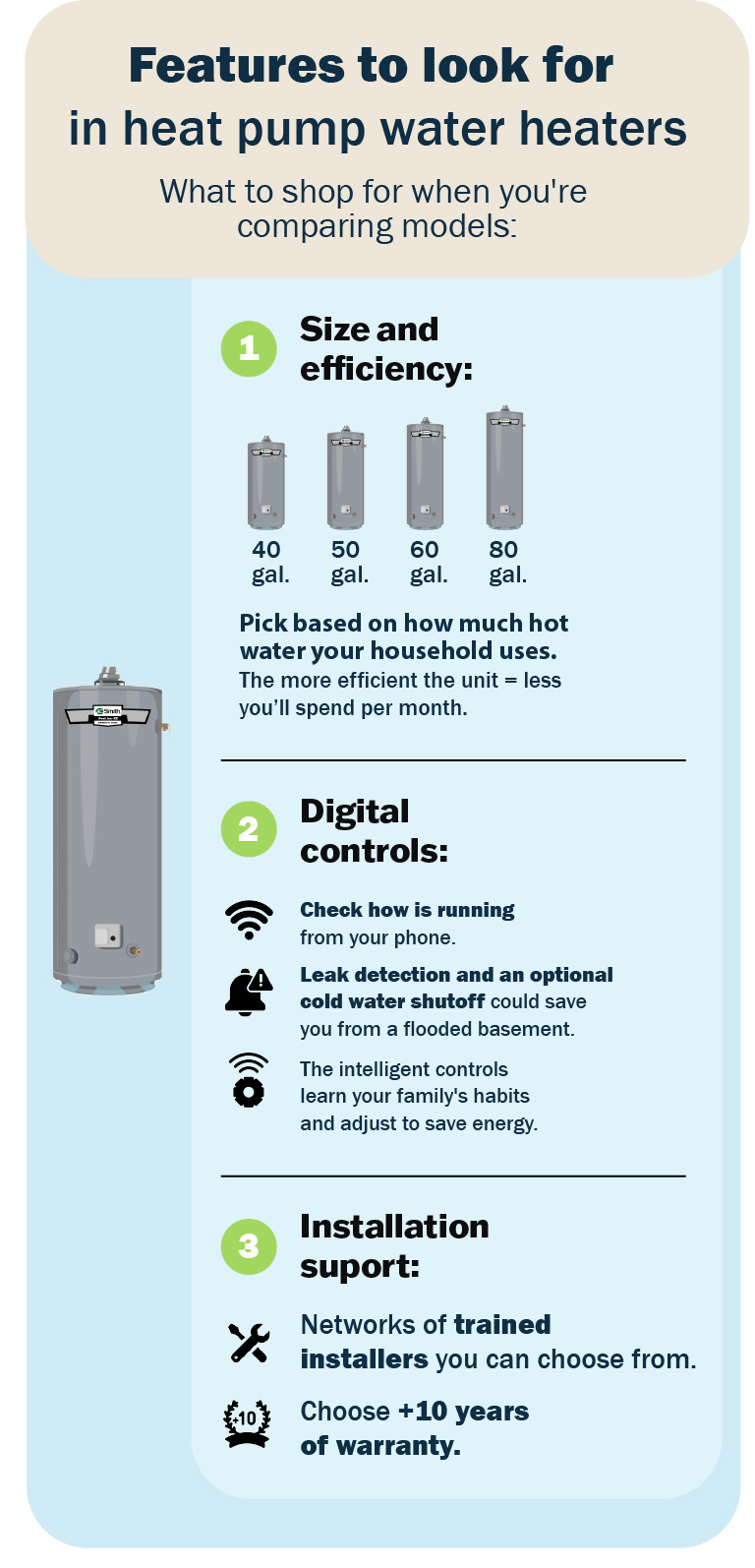

Features to Look for in Heat Pump Water Heaters

What to shop for when you're comparing models:

Size and Efficiency:

- They come in 40, 50, 66, and 80-gallon sizes—pick based on how much hot water your household uses.

- Stick with ENERGY STAR® certified units—they've met the government's efficiency requirements.

- The more efficient the unit, the less you'll spend on electricity each month.

Digital Controls:

- You can check how it's running and get alerts right on your phone if you get a Wi-Fi model.

- Leak detection and an optional cold water shutoff are available on some units—could save you from a flooded basement.

- The intelligent controls learn your family's habits and adjust to save energy.

Installation Support:

- Good brands have networks of trained installers you can choose from.

- Don't settle for short warranties—10+ years should be standard.

- Some brands use heavy-duty parts in their home models for extra durability.

Space and Setup

Heat pump water heaters need more space than regular water heaters because they pull in air to work properly. You'll typically need at least 450 cubic feet of air. Most basements, garages, and utility rooms work well. If your space is too small, special ducting can connect the unit to a larger area.

Professional installation is strongly recommended. These units are more complex than standard water heaters, and proper setup verifies they work efficiently and safely. Many manufacturers require professional installation to keep your warranty valid.

Before buying, have a qualified installer check your space, electrical setup, and plumbing. They can tell you if your home is ready or what changes might be needed.

Act Fast: Why Timing Matters

You had until December 31, 2025, to get this done. Plus, there's something bigger coming—new DOE rules that will shake up the entire residential water heater industry in 2029. The DOE sets efficiency standards that manufacturers must follow. Think of them as minimum performance requirements for appliances.

Major Changes to Residential Water Heater Standards in 2029

The new rules take effect May 6, 2029: Electric tank water heaters 35+ gallons will be required to use heat pump technology. This isn't optional.

Why this creates urgency for your decision:

- Avoid the Rush: Once 2029 rolls around, everyone will need these residential units, and prices may spike.

- Stack Your Savings: Hopefully, you were able to grab the tax credit now and skip the price hikes that always come with big regulation changes.

- Choose Refined Technology: Heat pump water heaters have been on the market long enough for manufacturers to improve their designs and reliability.

If you currently have an aging electric tank water heater, you'll eventually face this transition. Upgrade now with available incentives, or wait and buy during market disruption, when supply is tight and prices are higher.

Your Next Steps

Ready to start saving with a heat pump water heater? Follow these steps:

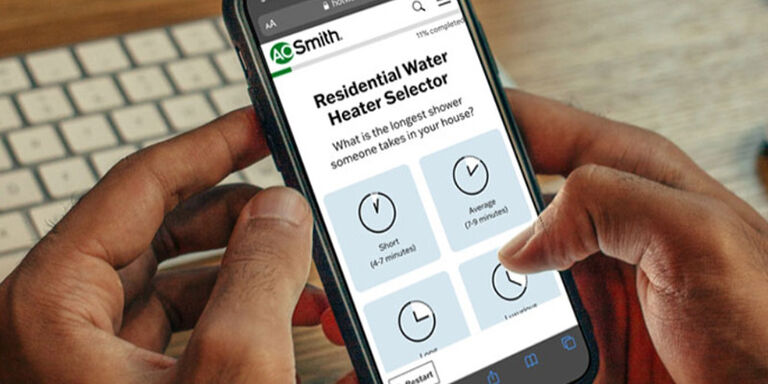

- Figure out what size you need with our residential hot water heater sizing tool.

- Find a local installer who knows heat pump systems.

- Get your space checked out to see what's needed for installation.

- Get local incentives - The federal tax credit ended on December 25, 2025, but there may be local incentives in your area that translate to significant savings.

- Consult with your plumbing contractor for eligibility for local incentives.

Get it installed by a Local Pro

A.O. Smith water heaters are available through your local plumbing professional.

Choose A. O. Smith for Your Heat Pump Water Heater Upgrade

For over 150 years, A. O. Smith has been one of America's leading water heating companies. Our ProLine XE® Voltex® heat pump water heaters deliver excellent performance with ENERGY STAR® certification, UEF ratings up to 3.88 (UEF measures how much energy goes directly into heating water versus being wasted), and help from our nationwide contractor network. We build our heat pump water heaters tough, using heavy-duty parts that last longer.

When you're ready to claim your federal tax credit, you'll need our manufacturer code: A5X5. Start by figuring out what size you need with our sizing tool, then find a local installer who can help.

Frequently Asked Questions

Heat pump water heaters do qualify for federal tax credits under the Energy Efficient Home Improvement Credit program.

ENERGY STAR® certified units were eligible for a 30% tax credit on total standard project costs, up to $2,000, but the incentive expired December 31, 2025.

You apply for the federal heat pump tax credit by filing IRS Form 5695 with your annual tax return.

You'll need to keep receipts for both equipment and installation costs, and include A. O. Smith's Qualified Manufacturer's (QM) code A5X5 when filing your federal taxes.

There is a firm deadline for claiming the heat pump federal tax credit because it ended on December 31, 2025. The equipment must have been purchased and installed by this date to qualify.

NOTICE: Include A. O. Smith's Qualified Manufacturer (QM) code A5X5 when filing a federal tax return form 5695.